Risk and Underwriting

More Courts. More Cases. Better Data.

Underwriters & Risk Managers have a tough job, but it just got a whole lot easier

“Premonition is positioned to become an industry leader, not just in legal analytics but analytics full stop”

Using Premonition data, the liability underwriter can quickly discover whether and to what extent an applicant, or key people that control it, have been sued, are suing others, and why?

Video : “Premonition can highlight D&O applicants with red flags”

For the LPL underwriter, the Premonition Database and our analysis of “win rates” can be golden data. More often a lawyer loses as compared to their peers, more likely they will eventually get sued.

Video : “See how often Lawyers take cases outside their expertise”

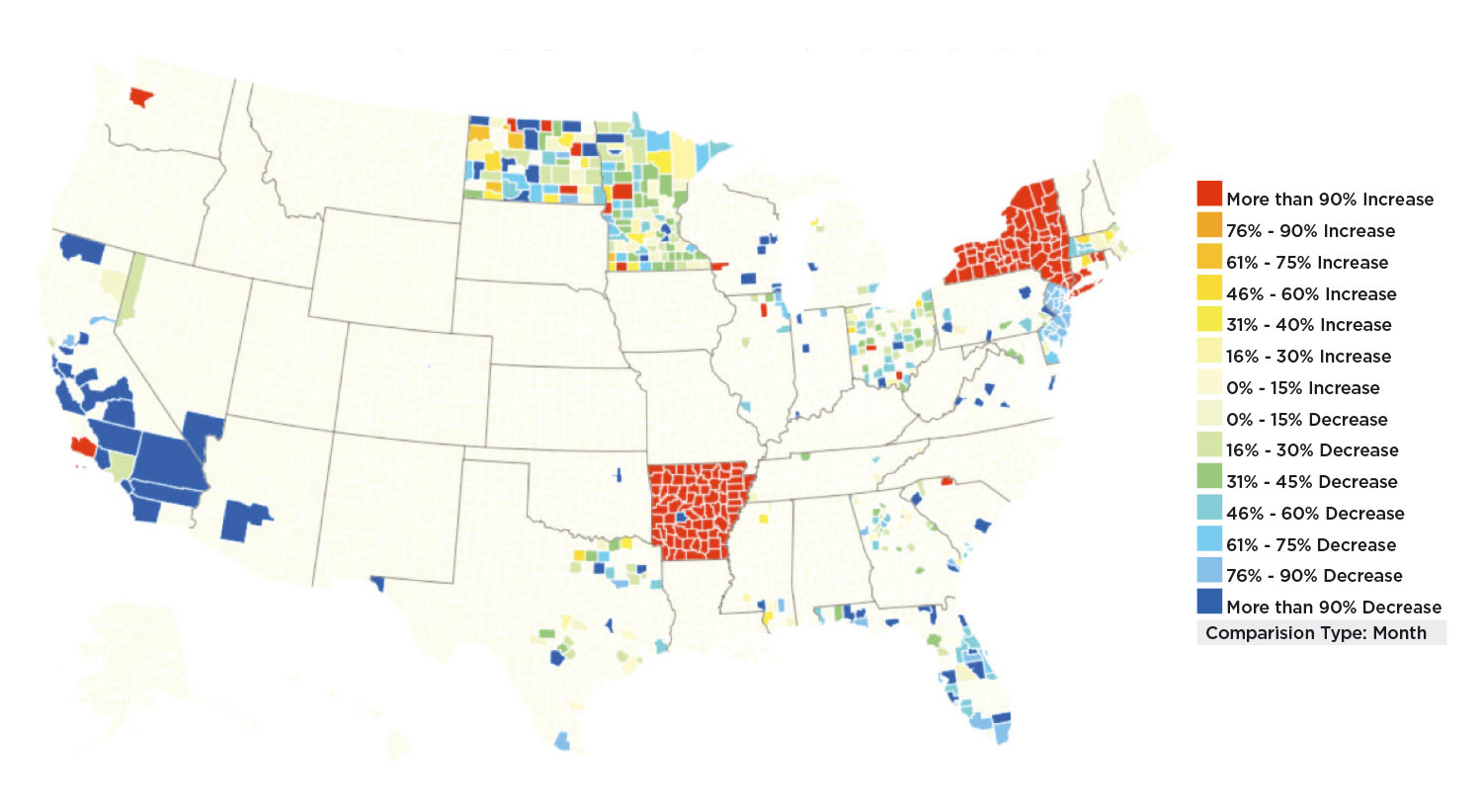

This is what drives the unique Premonition (“Moneyball for Law”) model ….

(1) acquire proprietary big datasets,

(2) apply AI and machine learning to them,

(3) arbitrage the market inefficiencies we find

Video : “Underwriters can discover, applicants litigation behaviour”